Exclusive: The truth about Bitcoin's new highs

Bitcoin is hitting a new all-time high once again. At the time of writing, it is trading at $123,200, marking a fifth consecutive day of ATHs amid rising interest from both institutions and retail investors.

Why is this happening?

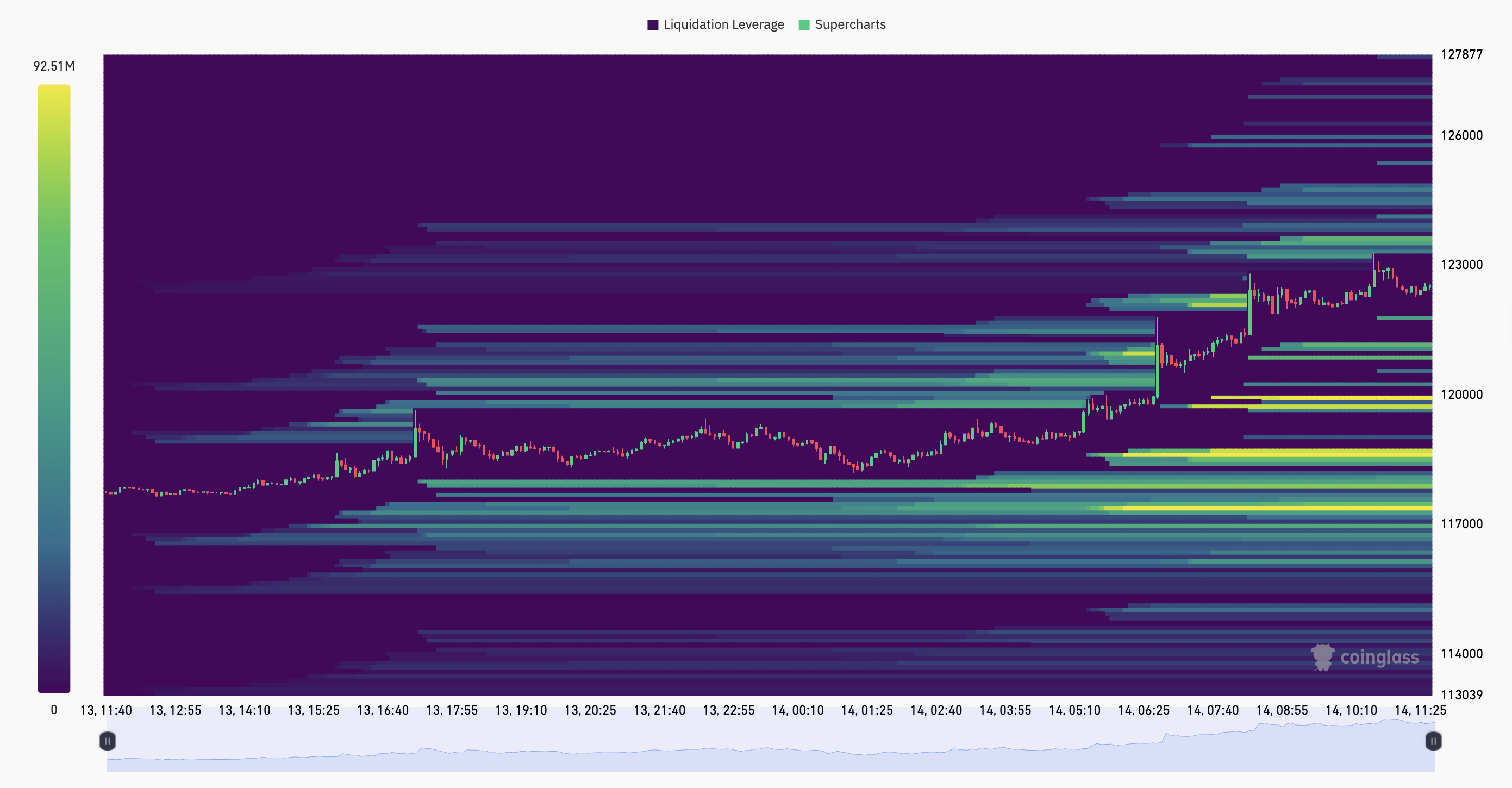

One of the main drivers is the wave of short liquidations.

Look at the yellow bars in the chart below – they represent approximately $2.5 billion in short liquidations on Binance alone.

When traders bet against Bitcoin and the price starts going up, they’re forced to buy back their positions to cover their losses – which further accelerates the price surge.

And this happened not just on Binance, but across multiple major platforms – with billions liquidated.

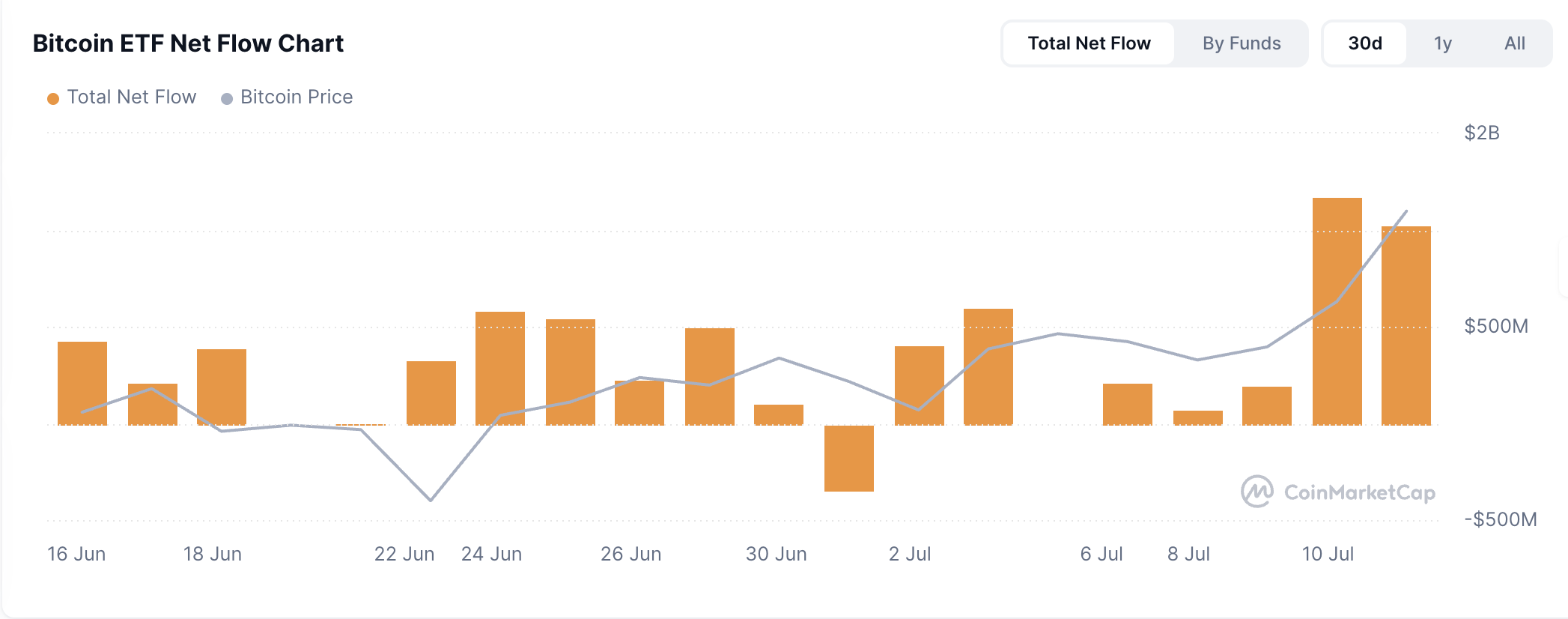

What triggered these liquidations? It seems that ETFs have been the main catalyst, intensifying institutional demand.

📅 What’s coming up this week?

This is a key week that could determine whether the bullish trend continues or takes a short break:

🔹 Tuesday (3:30 PM)

- U.S. CPI (Consumer Price Index) inflation data release

🔹 Wednesday (3:30 PM)

- PPI (Producer Price Index) data

🔹 Wednesday (3:30 PM & 11:30 PM)

- Retail sales

- Federal Reserve balance sheet

🔹 Friday (5:00 PM)

- Michigan University’s inflation expectations report

🎯 Make it or break it?

These events will show whether the market keeps its upward momentum or pauses temporarily.

All eyes are on the U.S. economic indicators, which will heavily impact the dollar, stock markets, and of course – Bitcoin.

🔔 Follow our blog and social channels for timely updates on these events and insights on how to position yourself in this market storm.