How to research companies with crypto portfolios?

In recent weeks, we’re witnessing a real boom: more and more public companies are officially announcing that part of their corporate treasury is now held in cryptocurrencies.

The latest addition to this list? Hyperliquid Strategies Inc. – a company that chose to add a next-generation crypto asset to its reserves.

But this is far from an isolated case.

If we take a step back and look at the bigger picture, we’ll see something even more interesting: companies not only investing in crypto, but building full-scale strategies around it – and their number is growing at a surprising pace.

🧠 What does it mean for a company to have a crypto portfolio?

When a public company decides to hold part of its capital in crypto assets, it builds what’s known as a crypto treasury. This is a strategy that bets on the future of digital assets as a reserve or growth instrument – just like MicroStrategy does with Bitcoin.

📌 How many companies are doing it?

🔹 Ethereum ($ETH)

📈 11 public companies

📆 5 of them joined just in the past month!

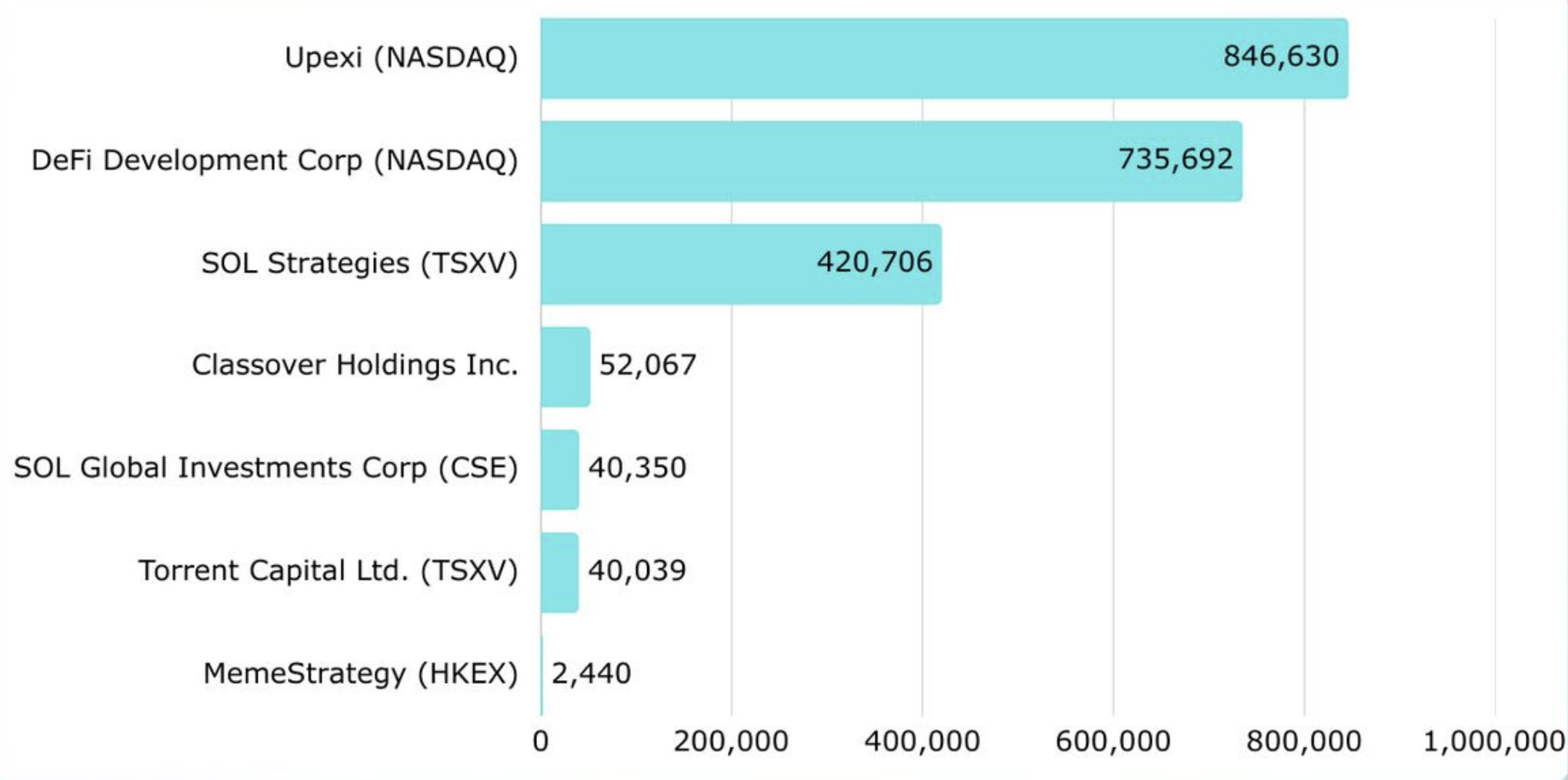

🔹 Solana ($SOL)

📈 7 companies

🔁 Most of them have even increased their holdings in recent weeks.

💰 And more:

- $500M upcoming investment from Mercurity Fintech

- $300M from BIT Mining

- $100M from Amber International

🔹 Bitcoin ($BTC)

😲 148 public companies

💼 Together, they hold over $103 billion in BTC!

✅ What does this mean for you?

Companies with crypto portfolios are becoming the next big trend.

And if you want to identify which projects deserve your attention (and potentially your investment), here are some key traits to watch for:

🧩 9 things we look for in a company investing in crypto assets:

- No excessive leverage

They focus on real crypto exposure without relying on huge loans.

- No constant share dilution

The fewer new shares issued, the higher the value per shareholder – or simply: more "Crypto Per Share."

- Hold yield-generating tokens

For example: staked ETH or other assets with built-in returns.

- Implement DeFi strategies

More DeFi tokens = more opportunities for income and growth.

- No high-interest loans

This makes them more resilient in bear markets.

- Invest in battle-tested cryptocurrencies

Those that have survived at least one bear cycle – that’s a good sign.

- Ability to raise capital via bonds

This attracts a broader base of institutional investors.

- Use loans with no liquidation risk

They use non-borrowed assets as collateral – avoiding forced selling during dips.

- Issue convertible debt

If their shares rise, they repay debt in equity – no need to sell crypto.

- Transparent crypto policies

Clear rules, limits, and risk management – so they don’t collapse at the first sign of volatility.

If until now you were only watching for the next token to "explode," maybe it’s time to also follow which companies are seriously investing in them.

❗ Important: This is not investment advice. Always do your own research (DYOR).

📬 Subscribe to our Telegram channel to stay up to date with future analysis and news.