Yield-bearingstablecoins: Why on-chain credit will be the big topic of the next few years (Part 1)

In crypto, there are periods when the market speaks through price.

And others, when it speaks through its structure.

Right now, we are in the second one.

While most participants continue to watch Bitcoin and altcoin volatility, a much quieter but fundamentally more important shift is already underway – credit is starting to move on-chain.

And the cleanest way this is happening is through yield-bearing stablecoins.

From “digital dollars” to working capital

For a long time, stablecoins had one main function – to act as a “parking place” for capital.

A waiting tool.

A bridge between trades.

A temporary shelter from volatility.

But that is gradually changing.

More and more users and institutions are asking a simple question:

Why hold dollars that do nothing, when I can hold dollars that work for me?

This is exactly where the new category appears – yield-bearing stablecoins.

They do not just track the value of the U.S. dollar.

They generate yield.

That makes them a qualitatively different financial instrument.

If we use an analogy – it is the difference between a checking account and a savings account. Or even more simply – between a non-dividend-paying stock and one that pays you regular income.

The choice is obvious.

The big thesis: credit is moving on-chain

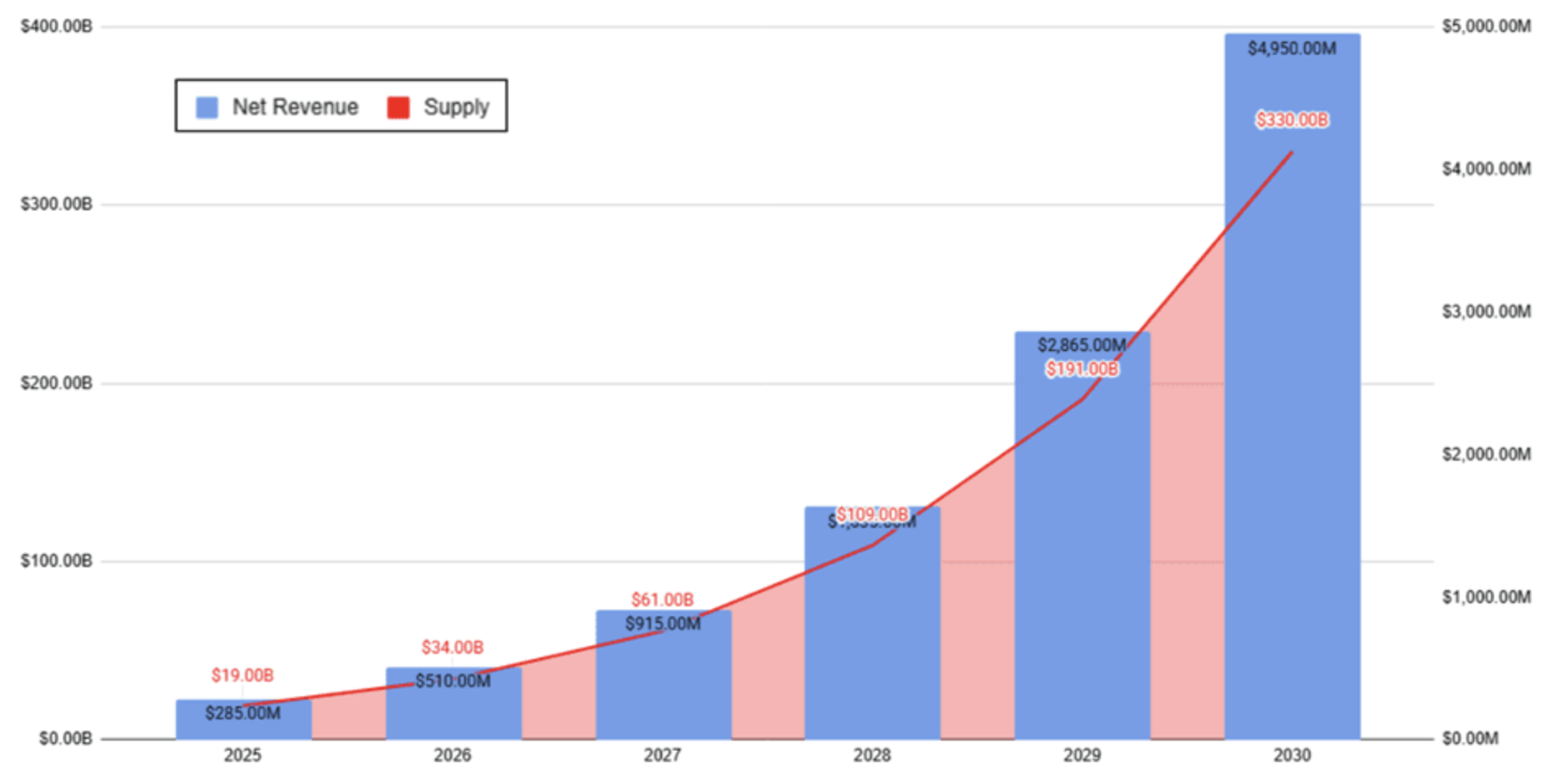

According to estimates from various analysts, the stablecoin market could reach $3 trillion by 2030.

That alone is impressive.

But what matters even more is which type of stablecoins will dominate that growth.

At the moment, yield-bearing stablecoins have a total supply of around $19 billion.

Expectations are for this figure to grow to $330 billion by 2030, implying roughly 80% annual growth.

This is not a niche.

This is a new financial layer.

The reason is simple – blockchain infrastructure allows:

- automated capital management

- transparent risk

- global access

- instant yield distribution

Things that in traditional finance are either too expensive or completely inaccessible to the average user.

Why on-chain instead of the traditional system?

Because the technology is better.

No waiting for days.

No hidden fees.

And most importantly – no geographic limitations.

When we talk about credit and yield, we are talking about massive markets:

- bonds – over $130 trillion

- bank deposits – over $100 trillion

- money market funds – over $10 trillion

Even a minimal shift of this capital on-chain has the potential to completely change the structure of the crypto market.

And this is already starting to happen.

Regulation does not stop decentralized solutions

A common argument is that new regulations could limit yields on stablecoins.

And in the short term – this applies to centralized companies.

But decentralized protocols do not fall under the same rules.

Platforms built on-chain have significantly more freedom to:

- experiment with new strategies

- build defensible models

- create scalable products before traditional players catch up

This gives them a time advantage, which is often the most valuable resource in a new market.

Why this market is so attractive to investors

There is one more key element that sets yield-bearing stablecoins apart from most of the crypto market.

Their growth is not directly dependent on Bitcoin’s price.

Even during downturns, when speculative capital exits, demand for yield remains.

In some cases – it even increases.

This creates business models that can grow independently of the market cycle.

For investors, this means:

- more predictable revenue

- lower correlation with volatility

- stronger fundamentals

That is exactly why more analysts are starting to view this sector as one of the most resilient within the crypto ecosystem.

👉 This is where we stop Part 1.

In tomorrow’s article, we will continue with:

- the main categories of yield-bearing stablecoins

- how the strategies behind them actually work

- what secondary effects will emerge as this market grows

- and which projects appear best positioned for the coming years

If you want to understand where value is actually created, not just where price moves – the continuation is worth it.

Expect Part 2 tomorrow.