Top 3 news stories that could change the crypto market this month

September may look relatively “flat” in terms of price action on the crypto market…

But behind the scenes, momentum is building that could give a powerful push in Q4.

Here are the three main headlines pouring fuel on the fire today:

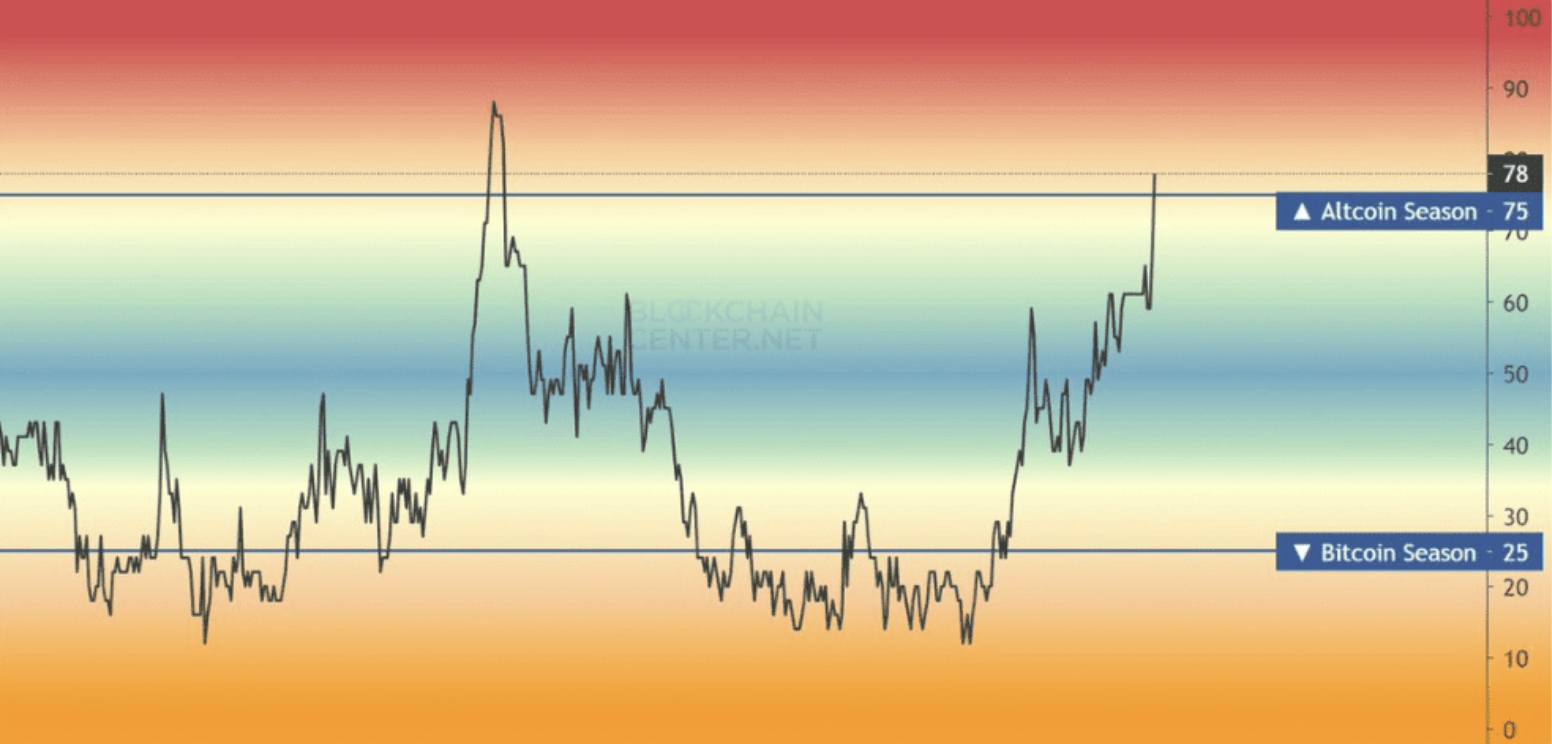

Alt season is here (in theory)

75% of the top 50 cryptocurrencies by market cap have outperformed Bitcoin over the past 90 days. This means we are officially in alt season.

⚠️ Important note: this “switch” is mostly due to the fact that BTC dipped slightly while alts stayed stable.

The truly explosive gains, however, come when both BTC and alts rise – but the latter do it faster.

Memecoins enter TradFi

Starting today, XRP, DOGE, BONK and TRUMP will be available to investors on regulated U.S. exchanges. This implies a fresh inflow of capital from traditional finance.

Will that be enough to sustain the alt season momentum? Quite possibly.

Forward Industries raised $1.65B

Forward Industries completed its funding, raising $1.65B to build a Solana wallet. The next step is purchasing an even larger amount of SOL – a move that could directly impact the price and liquidity on the network.

Bonus: CPI data

Today’s inflation data (CPI) matched market expectations, giving the Fed yet another reason to cut rates this month.

But let’s also look at the dark side: DATs and long-term risks 🥴

More and more companies are adopting the Digital Asset Treasuries (DATs) model – raising capital and buying crypto for their corporate balance sheets.

Examples from the past month:

- Forward Industries (Solana)

- Eightco Holdings (Worldcoin)

- Sonnet BioTherapeutics (Hyperliquid)

- CleanCore Solutions (Dogecoin)

- CaliberCos (Chainlink)

🔄 The problem? These companies often enter the market with a big “pump,” followed by a sharp drop – “rip n’ dip.”

How can risk emerge?

Many DATs finance their purchases through long-term convertible bonds. They work like this:

- Investors buy 5-year bonds

- They receive interest

- If the stock rises – they take shares

- If not – the company must pay back the money in cash

Here’s the catch: if the token doesn’t perform well, a DAT has to sell assets to return cash. That creates a downward spiral:

1. Token selling → price falls

2. Company balance shrinks → stock price drops

3. More investors demand cash → more selling

In the worst case, this can hit not only the specific token, but also other DATs that hold the same asset.

What should we watch?

- DATs holding assets with a proven growth history (5+ years)

- Teams with reputation and access to financing if needed

- Examples: Michael Saylor / MSTR, Tom Lee / BMNR, Mike Novogratz / FORD

The market may not have exploded yet, but the tension and news indicate that an interesting Q4 lies ahead.

Alt season is gaining momentum, memecoins are breaking into traditional finance, and institutional interest in crypto is rising.

❓ The question is: will DATs become the catalyst for the next rally… or a potential weakness in the market?

👉 Share your opinion in our Telegram group