Risk management: why survival is more important than profitability

In crypto markets, the problem is rarely a lack of opportunities. More often, the problem is that people don’t last long enough in time to benefit from them. That’s why risk management is not an extra layer. It is the foundation on which participation in the market makes sense at all.

This is not investment advice!

This is a framework for discipline.

How much to risk per trade

- The risk on a single position should not exceed 1–2% of the total portfolio. This rule does not make results spectacular, but it makes them sustainable. Even a series of mistakes will not lead to a fatal drawdown.

The reason for this limit is simple math.

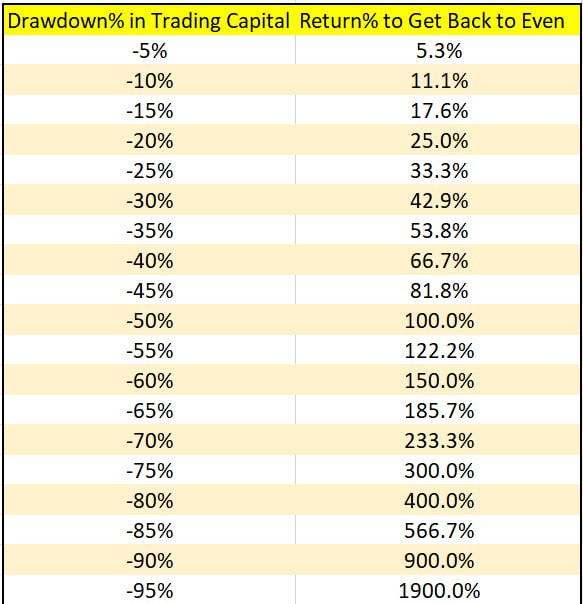

The larger the loss, the disproportionately higher the return required just to get back to break-even.

For example:

- With a 50% portfolio drawdown, you need a 100% return just to get back to where you started.

- With a 90% drawdown, you need 900% to break even.

This has nothing to do with confidence, experience, or a “good feel for the market.”

It is pure arithmetic. The deeper the loss, the harder the recovery.

That’s exactly what the table below illustrates.

That’s why limiting risk to 1–2% per trade is not a conservative approach, but a way to avoid situations from which there is mathematically almost no recovery.

This is also one of the reasons we are extremely cautious with long-term exposure to altcoins.

Historically, in almost every market cycle, a large portion of altcoins go through drawdowns of 90% or more.

With moves like that, it’s no longer just about “waiting for the market to come back.”

It’s about whether the portfolio can realistically recover at all without taking excessive risk.

- Every position must have a predefined exit if you’re wrong. If there is no clear level at which you accept that the thesis failed, the decision is no longer planned – it becomes emotional.

Position size matters

- No single position should exceed 20% of the portfolio. Concentration creates a sense of confidence, but it carries risk. One mistake can wipe out months of progress. Even good trades can go wrong at the wrong time.

Diversification is not the number of tokens

- True diversification is not just owning more assets. Positions in the same sector tend to react similarly under stress. That doesn’t reduce risk – it just spreads it superficially.

- Balance should be across sectors and market capitalization, not just names. The goal is not the maximum number of exposures, but lower correlation between them.

Liquidity: why cash is not a “missed opportunity”

- Keeping 10–20% in stablecoins is a form of protection. Liquidity allows for:

- reacting to new conditions;

- pausing during uncertainty;

- avoiding rushed decisions.

A portfolio without cash is a portfolio without flexibility.

Psychology is also a risk

- If you constantly watch prices or feel tension, the position size is too large. This is not about experience, but about exposure. Reducing it is a rational decision, not a retreat. Mental comfort is part of capital management.

If you want broader context on the crypto market and the core principles behind it, we also have a free booklet with collected “golden rules.”

Markets will continue to move. Opportunities will exist tomorrow and a year from now. The question is not whether the market will offer a chance, but whether the portfolio will be able to meet it. That’s why:

- first, protect capital;

- then seek returns!

This order is not accidental.