PumpFun reclaims its crown: How the platform's new moves changed the Solana market

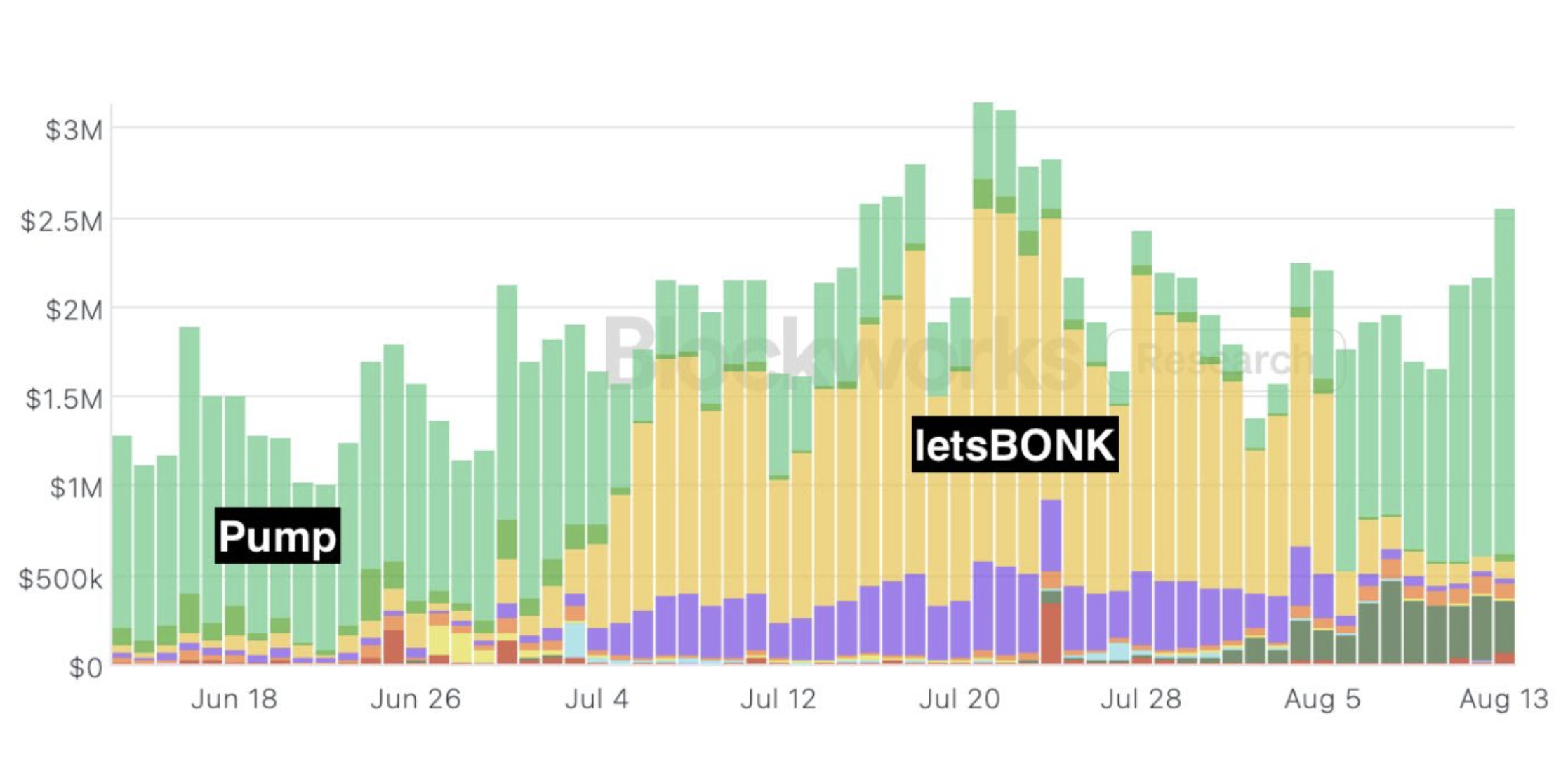

Sometimes the market has a short memory. Just two weeks ago, many had written off PumpFun – the Solana-based platform for launching meme coins.

The reasons were clear:

- Competitor letsBONKfun was aggressively taking market share.

- The token buyback program was difficult to track and failed to spark excitement.

- There was no new incentive to reignite community interest.

But the PumpFun team reacted instantly. Here’s what has happened since then and why $PUMP is back on top.

1. The new community token buyback initiative

PumpFun launched the Glass Full Foundation (GFF) – a fund that buys leading meme coins created on the platform.

In just two weeks, the fund has received $1.69 million in investments, and successful projects now have a chance to receive backing from PumpFun’s war chest, which stands at $1.3 billion.

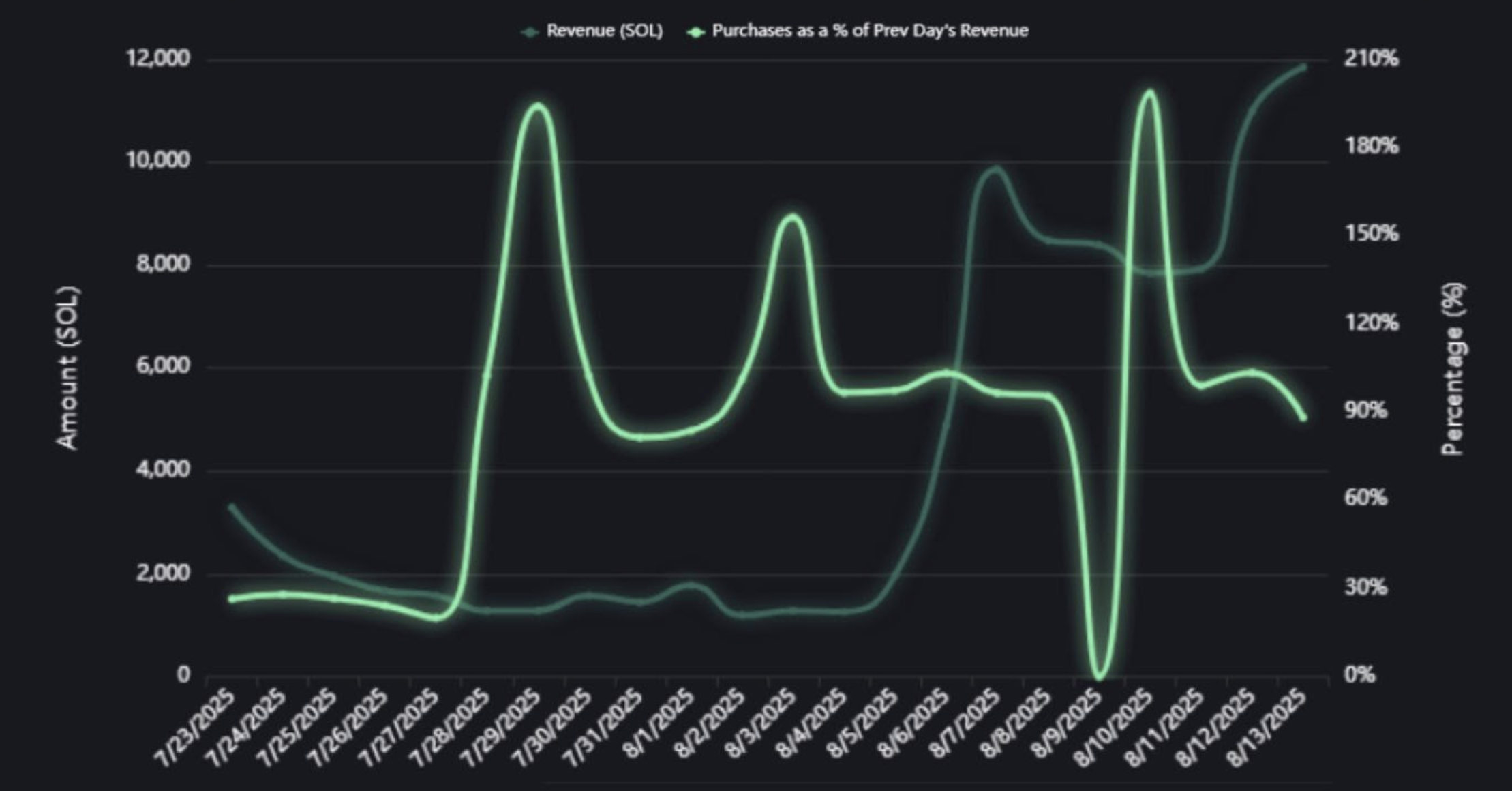

2. Public $PUMP buyback dashboard

Initially, PumpFun announced that 25% of revenue would be used to buy back $PUMP, with the tokens redistributed to holders.

The problem? It was hard to track. You had to be a blockchain “detective” or constantly monitor Twitter.

The solution: a new public buyback dashboard showing all purchases in real time.

Most importantly – the daily buyback rate is now between 80% and 200% of daily revenue, compared to the initial 25%.

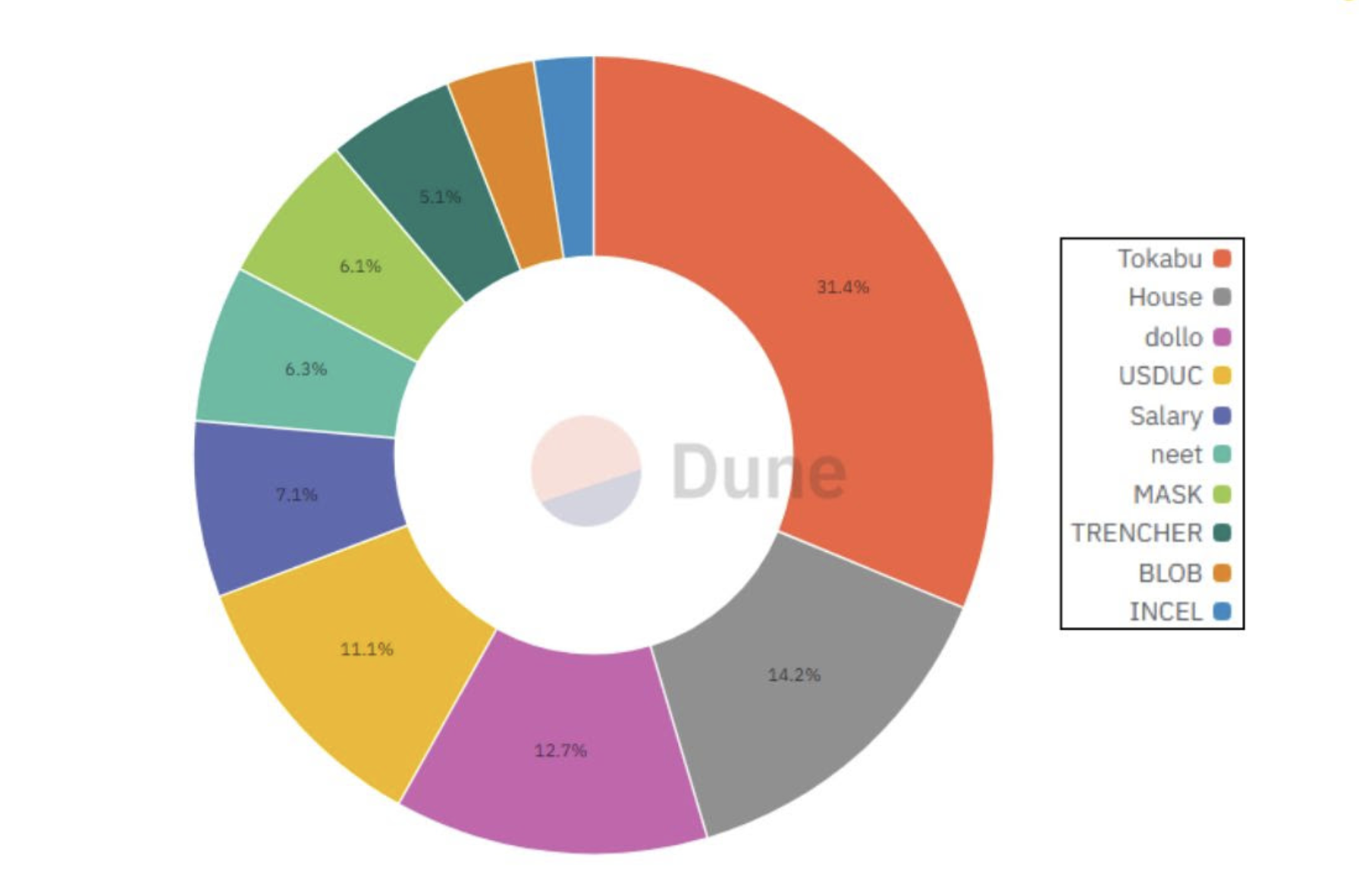

3. Sharp increase in market share

The results came quickly – PumpFun’s market share of Solana Launchpad revenue jumped from 10% on August 3 to 76% on August 13.

This also led to a price effect – $PUMP is up by about 42%.

What does this mean for investors?

The PumpFun story is a reminder that in crypto, speed of adaptation is everything. The team didn’t just respond to criticism – they turned their weaknesses into strengths and regained their leading position.

PumpFun’s next big move will show whether this rise will continue or remain an impressive but short-lived reversal.

If you want to catch such opportunities in time, check the Altcoins.bg blog, where we regularly publish analyses and news about high-potential projects.