From Altcoin to Appcoin Season: Why Are Apps Becoming the New Stars of the Crypto Market? - PART 1

The crypto market is on the move again, but this time the spotlights aren’t pointed at blockchain infrastructures. Instead, the real profits are piling up elsewhere – in the applications that don’t just promise a future but are already making money. In this article we’ll look at why an „appcoin“ season is coming, how it differs from the classic altcoin hype, and what signals to watch if we want to ride the wave.

Applications are eating the blockchains

At least when it comes to… making money. And if you’re an investor, that’s exactly what matters – especially today.

Why? Our macro outlook for the coming months is bullish, and that could set the stage for a powerful altcoin rally.

But with tens of thousands of tokens out there, don’t expect them all to move alike.

👉 We believe the apps that are already raking in millions in revenue are best positioned to ride the incoming “altcoin season”…

…or maybe it’s time to call it something else: an “appcoin season”?

The difference is huge between applications that deliver a real product and generate revenue, and tokens that are just waiting for the next hype wave to pump their price.

People who invested in real, profitable applications don’t need hopes or prayers.

They follow a proven strategy: put money into a business that earns today and will likely earn even more tomorrow.

Last cycle the spotlights were on blockchains, and they booked massive gains.

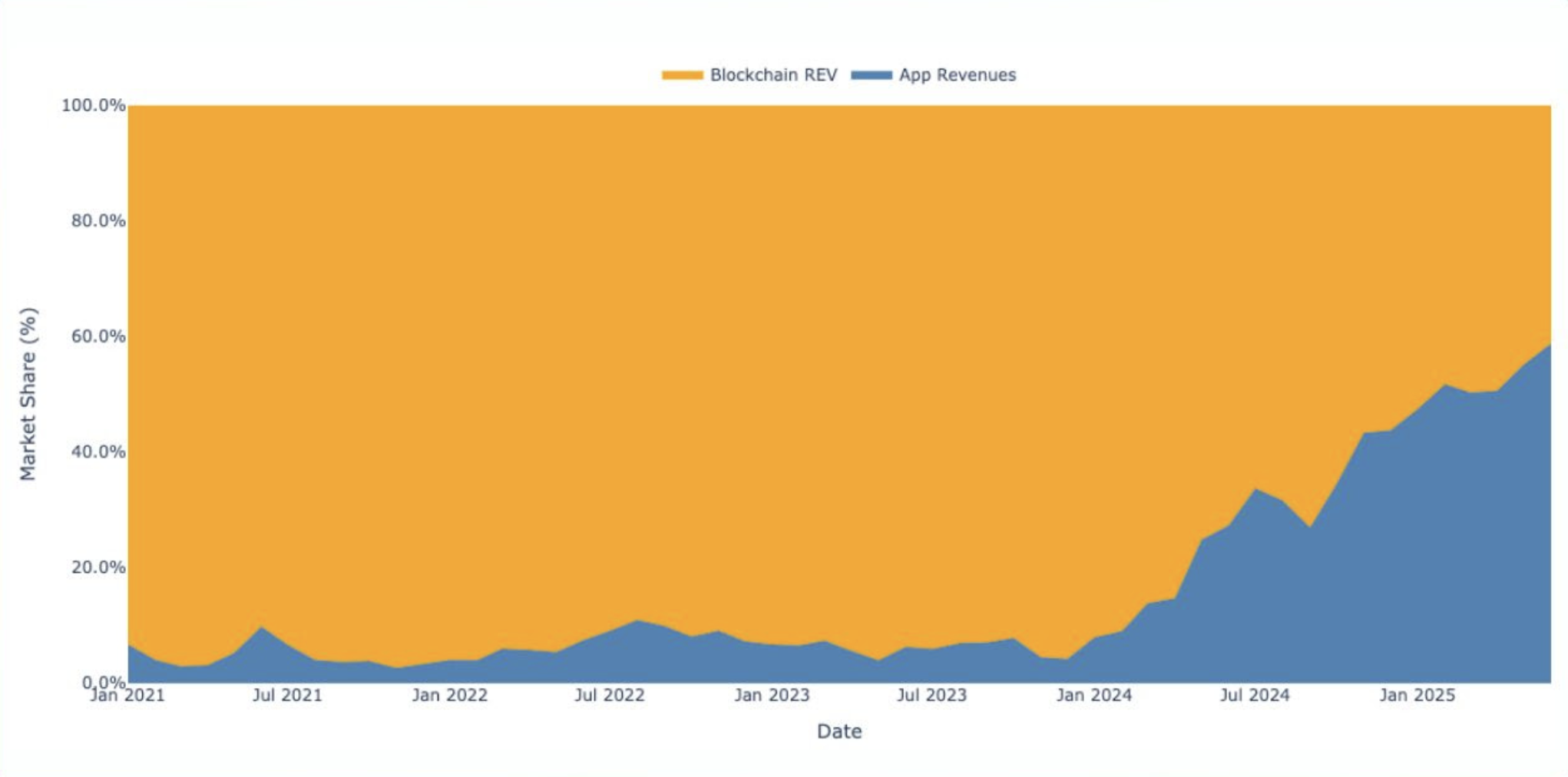

This time? There’s a real chance applications will come to the fore – and the trend is already visible. (see the chart in the source)

Applications are already taking the lion’s share of the money

Since the start of 2024, apps have been gaining momentum and today hold 63 % of total revenues, versus 37 % for the blockchains themselves. The trend cooled a bit in recent weeks, but we expect next month to ignite a new dominance wave and push that share even higher.

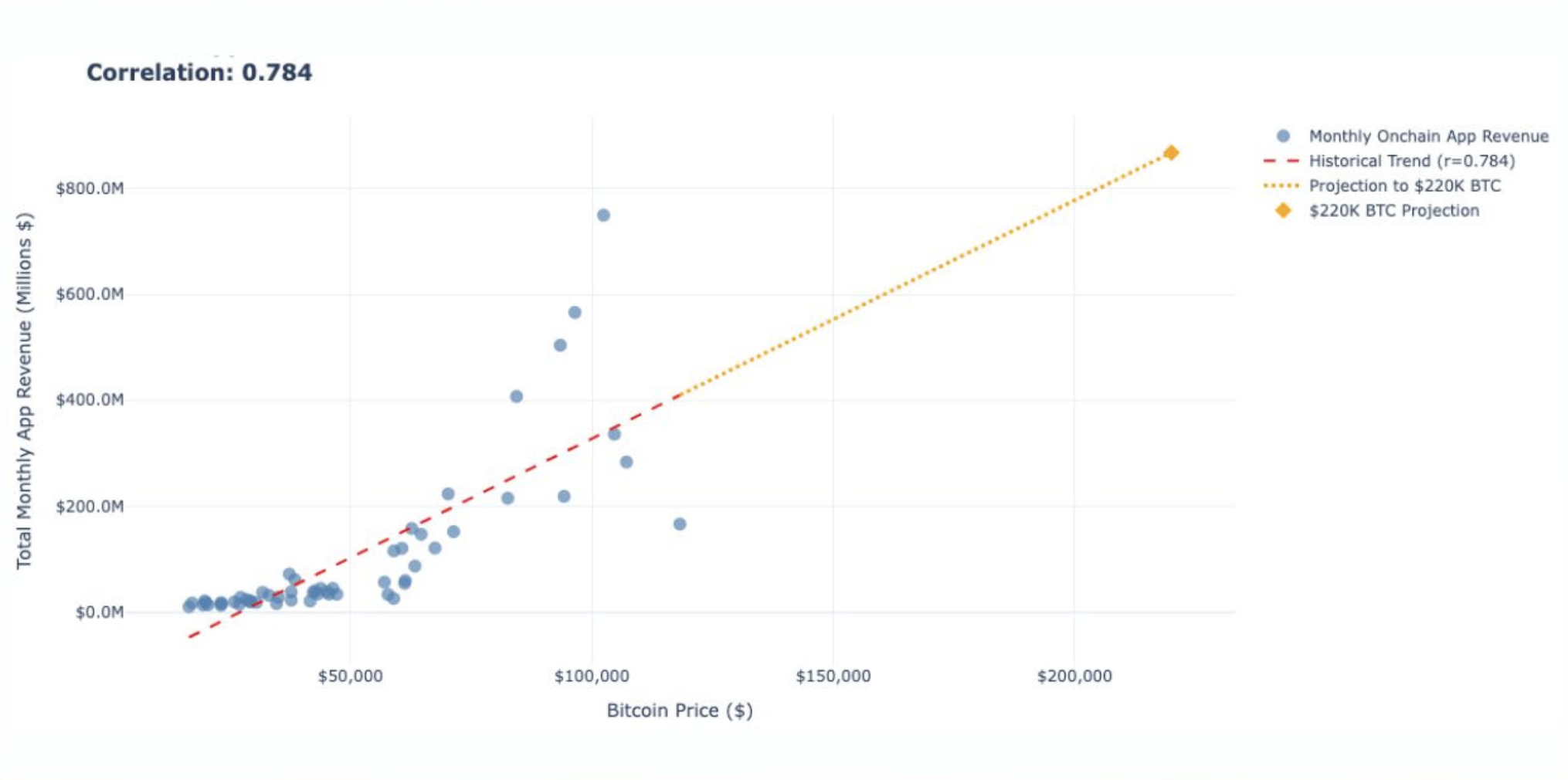

Bullish on Bitcoin = Bullish on app revenues

Many are bullish on Bitcoin. So are we. And when $BTC rises, on‑chain app revenues usually follow.

The correlation is 0.784, which is pretty solid (1 means a perfect relationship).

If we assume $BTC doubles its previous ATH and hits $220 000, then monthly app revenues could climb to around $1.4 billion.

That’s 4× compared with today’s ~\$350 million.

👉 Revenues could jump 4×, so it’s reasonable to expect prices to move in a similar direction.

Of course, not all apps grow at the same pace. Some scale revenue much faster – those are the ones we want to hold.

The questions we ask ourselves…

- Which sectors earn the most revenue today?

- Which are growing the fastest?

- Can they scale further?

- Who are the top applications in each sector?

- Do we need to reposition our portfolio to catch this (app) wave?

APP REVENUES – What exactly is an app?

Apps = businesses that use blockchain to deliver real products/services with a clear goal – generating revenue and maximizing profit.

BUT...

App fees ≠ app revenues

Example:

You swap $USDC for $ETH on a DEX like Uniswap. You pay ~0.05 % trading fee → app fee.

- 87 % goes to liquidity providers – they make the trade possible.

- 13 % remains for the DEX itself → app revenue.

In other words, fees are what users pay. Revenues are what the app keeps.

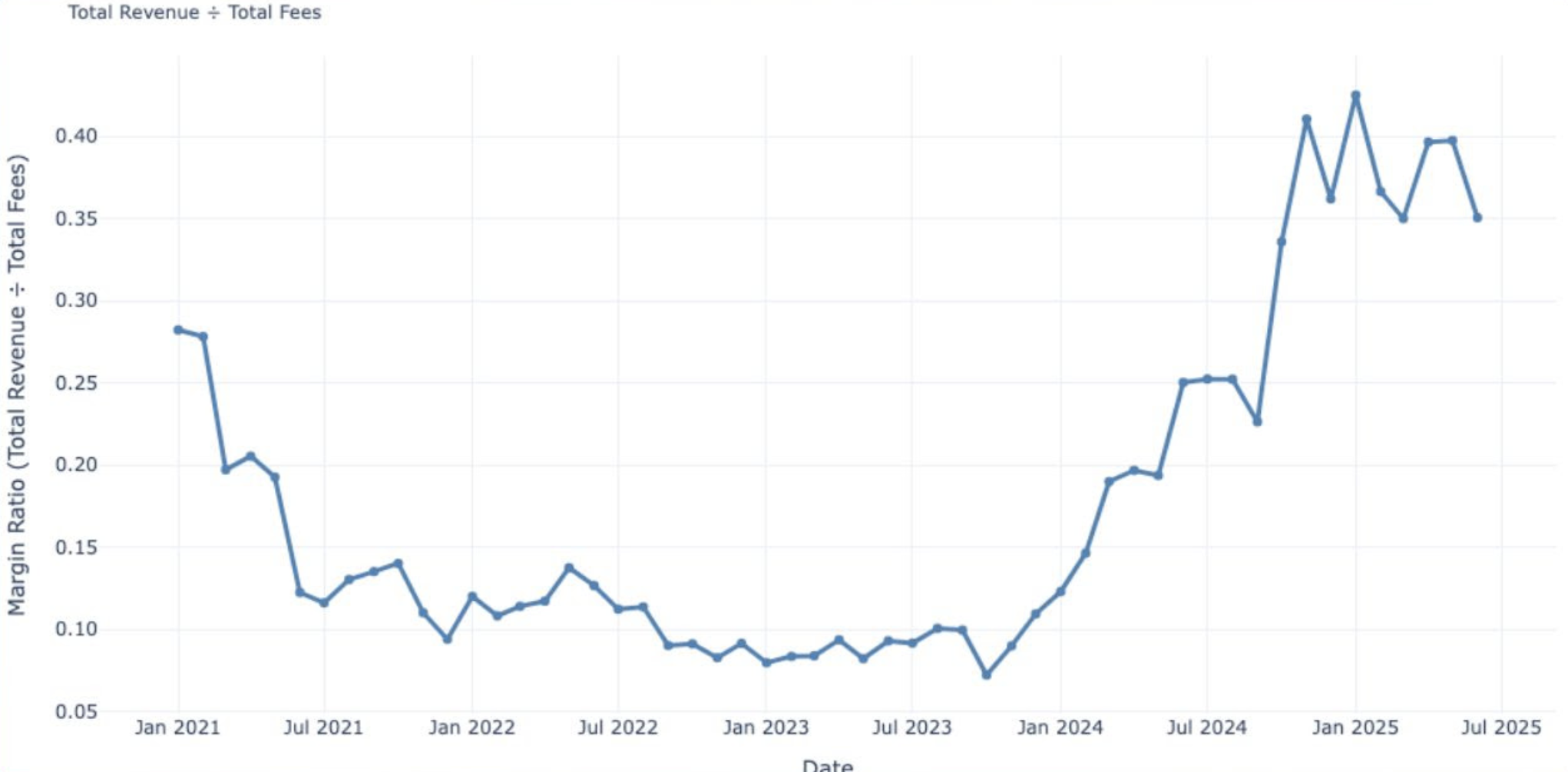

Margins vary:

- DEXes – ~13 %

- Lending protocols – ~26 %

- Some trading tools – almost 100 %

Average margin → 32 %: for every \$1 in fees, the app keeps about \$0.32.

Revenue bottom? Probably yes.

Since April 2024, monthly app revenues have held around \$350 million.

Eighteen months of “digging the bottom” suggest the worst is behind us. That’s a solid foundation to build on.

If we’re right about the potential 4×, the next step is to identify the most promising sectors and find the leaders.

👉 Because leaders often keep leading, and when revenues rise they set the pace.

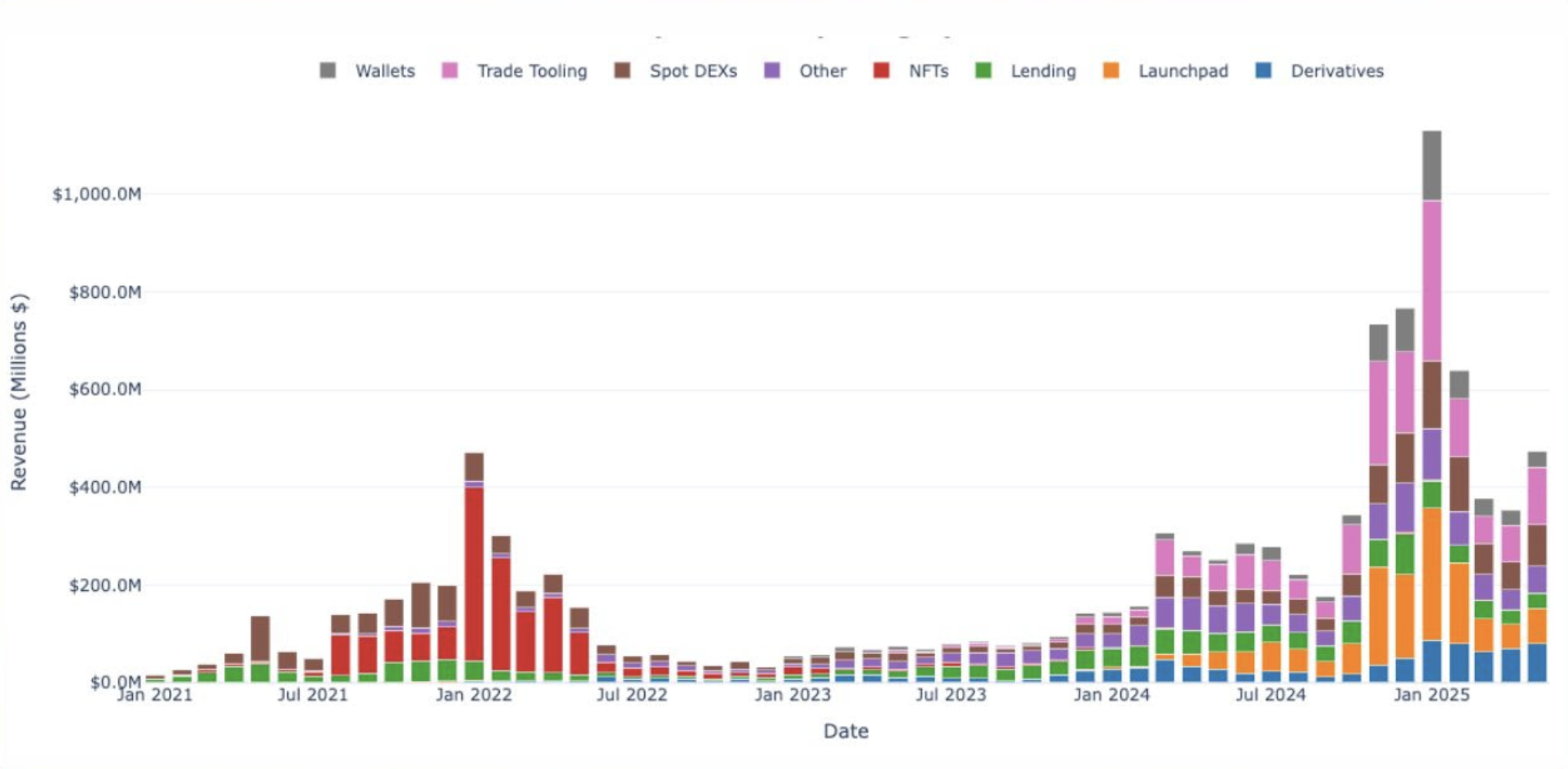

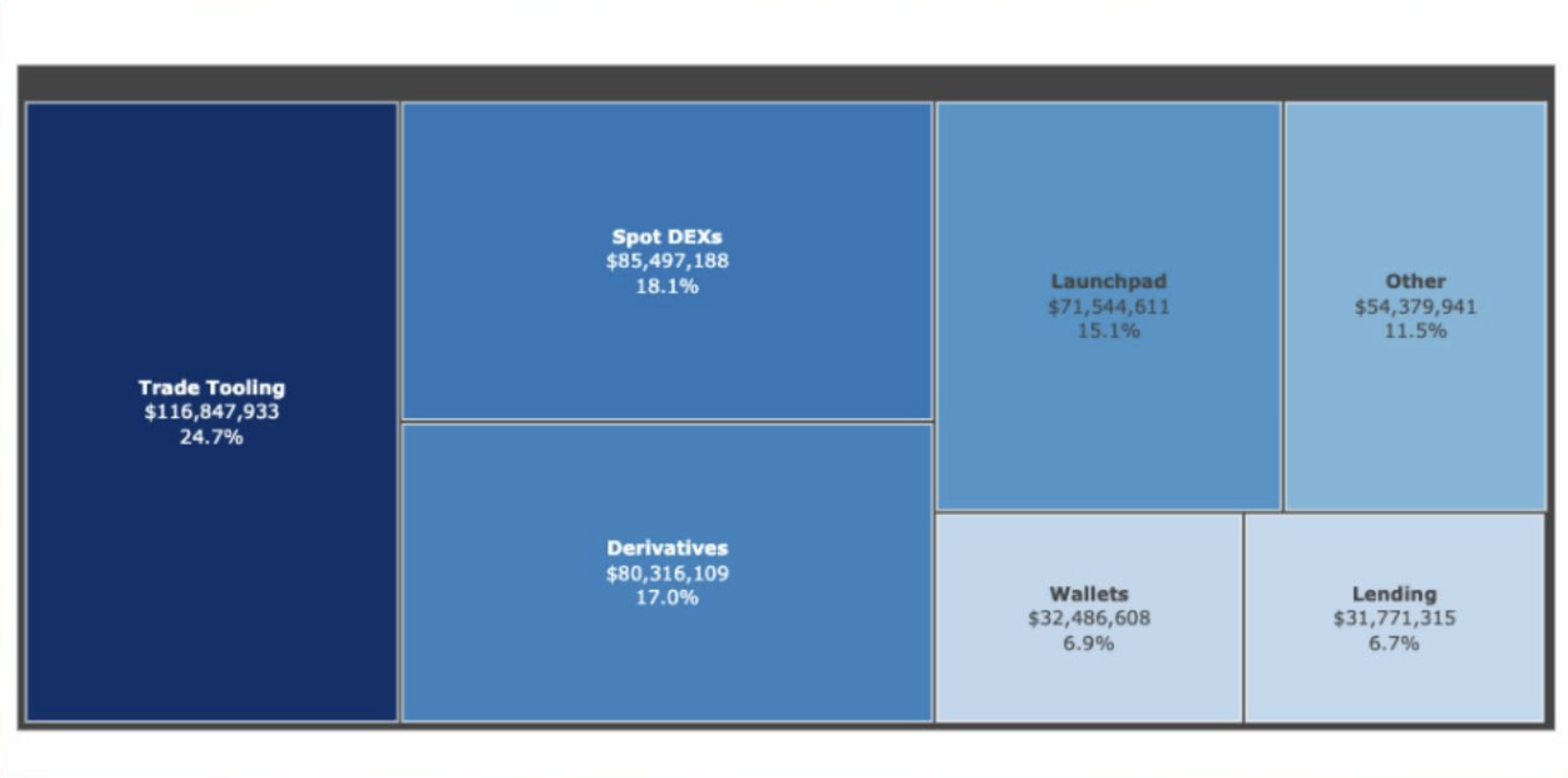

So far we’ve outlined the big picture. The natural next question is: Exactly where in the ecosystem is the most money being made today, and which categories are in front?

In June 2025 total app revenues hit \$473 million – an impressive sum. Some leaders are surprising; others were expected.

It’s time to dive deeper and look at them one by one…

This is the end of Part 1.

This was just the beginning! In Part 2 we’ll dive deep into each profitable category, pull out the concrete leaders, and show how to include them in your portfolio before “appcoin season” reaches full speed. Stay tuned – the continuation is coming very soon!