If you're still not bullish about Ethereum, read this!

Before we dive into today’s article, we’ve got one quick question:

Are you feeling bullish on Ethereum?

Answer to yourself.

Great – we’ll ask again at the end.

(And if your answer was “no” – let’s see if you change your mind...)

BlackRock goes all-in – $500 million in ETH in a single day

The BlackRock Ethereum ETF bought tokens worth $500 million – in just 24 hours.

For context: just a day earlier, all other $ETH ETFs in the US saw a combined inflow of about $192 million. Meaning BlackRock basically doubled the entire market. This isn’t just interest – this is strategic positioning by the world’s largest asset manager.

BlackRock plans to add staking to its Ethereum fund

BlackRock has officially filed an application with the SEC requesting permission to allow ETH staking within its iShares Ethereum Trust.

If approved, this means that the world's largest asset manager will not only hold Ethereum but also actively participate in the network, triggering validation and earning rewards. This is a strong signal that Ethereum and its entire DeFi ecosystem will be cemented as a fundamental part of the new financial infrastructure.

Other ETH ETFs follow suit – another $250M in one day

That same day, the remaining Ethereum ETFs in the US added another $250 million.

For comparison: during the first week of July, these funds only once surpassed $100 million in daily inflows.

📈 Simply put – interest is accelerating, and fast.

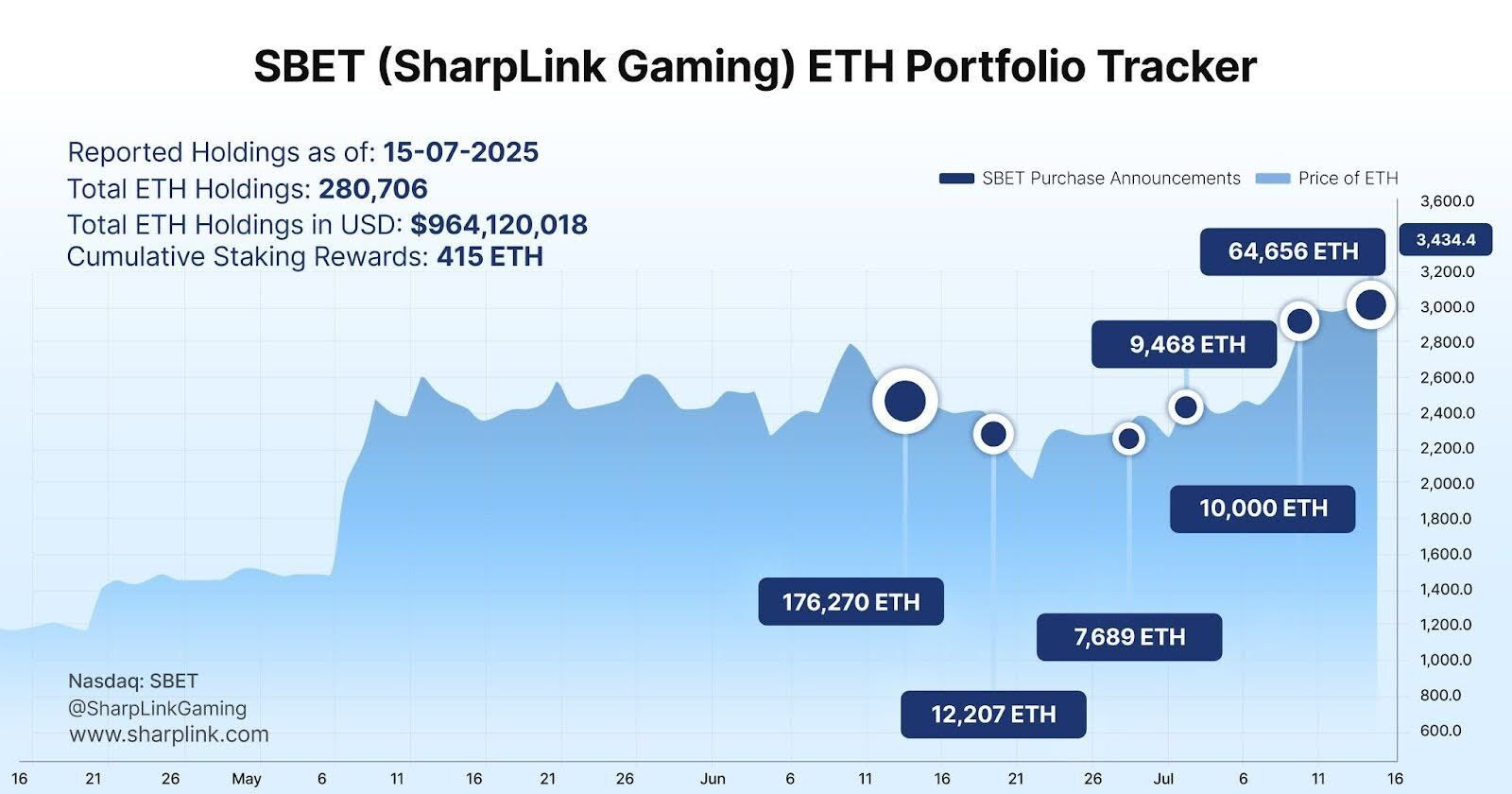

SharpLink Gaming adds another $100M in ETH

Tech company SharpLink Gaming ($SBET) added an additional $100 million in Ethereum to its portfolio.

Their total ETH holdings now stand at 280,706 ETH.

Their ambitious goal? Over 1 million ETH. 🔥

BitMine announces $1 billion in ETH holdings

BitMine ($BMNR) also raised the bar – they currently hold $1 billion in ETH, and have plans to grow this number to $2 billion.

And we wouldn’t be surprised if that target is raised again soon…

What does all of this mean?

Within just one day, Ethereum attracted nearly $1 billion in institutional interest.

Don’t forget – when institutional capital flows into Ethereum, it isn’t just buying a token, it’s buying access to the entire DeFi ecosystem built on top of it.

With every new wave of capital into $ETH, we see key DeFi components react and grow – in terms of both Total Value Locked (TVL) and overall market share vs other blockchains.

We can expect to see a major surge in activity on Uniswap, the largest decentralized exchange (DEX) on the Ethereum network. The same goes for top lending protocols like Aave, where more assets are being locked to earn passive yield or used as collateral.

Now go back to the start and answer again:

Are you bullish on Ethereum?

We already know our answer.

And if you want to benefit from growing institutional interest – $ETH is available for purchase and exchange on our platform.