The big test for crypto: Friday could decide everything

The weekend was nothing short of explosive!

Ethereum hit a new all-time high, the chances of a U.S. rate cut in September spiked sharply, and in family chats around the world you could hear lines like:

“Who’s investing in silly internet money now, dad?”

But what should we watch this week to keep the party going in the markets?

Macro 🌎

The key events in the economic calendar:

- Thursday – U.S. GDP for Q2 2025 – we’ll see how much the economy has grown or shrunk.

- Friday – Michigan Consumer Sentiment Index – are people in the mood to spend?

- Friday – PCE Inflation Index (Preferred Consumer Expenditures) – how much prices for goods and services changed in July.

🔑 The most important: Friday’s PCE data.

Last week, Fed Chair Jerome Powell gave a rather positive speech at Jackson Hole. The result? Markets boosted their expectations of a rate cut in September.

According to Polymarket, the probability of such a decision jumped from 61% before the speech to 83% after it.

If Friday’s inflation data shows a decline – expect more optimism and a possible boost for crypto.

Earnings Reports 💰

Forget all the other reports this week – the key one is: NVIDIA ($NVDA).

It’s not only the largest company in the world by market capitalization but also a true thermometer for the entire tech sector.

If NVIDIA delivers a positive surprise – that’s a good signal for the rest of the markets, including crypto.

Charts 📈

Last week we pointed out two key levels:

Bitcoin – $112k

Ethereum – $4.1k

📊 Today the situation is as follows:

ETH pulled back slightly and is currently around $4,400.

BTC is already below the key $110k level – and if it stays there on the daily chart, we’ll likely see short-term weakness.

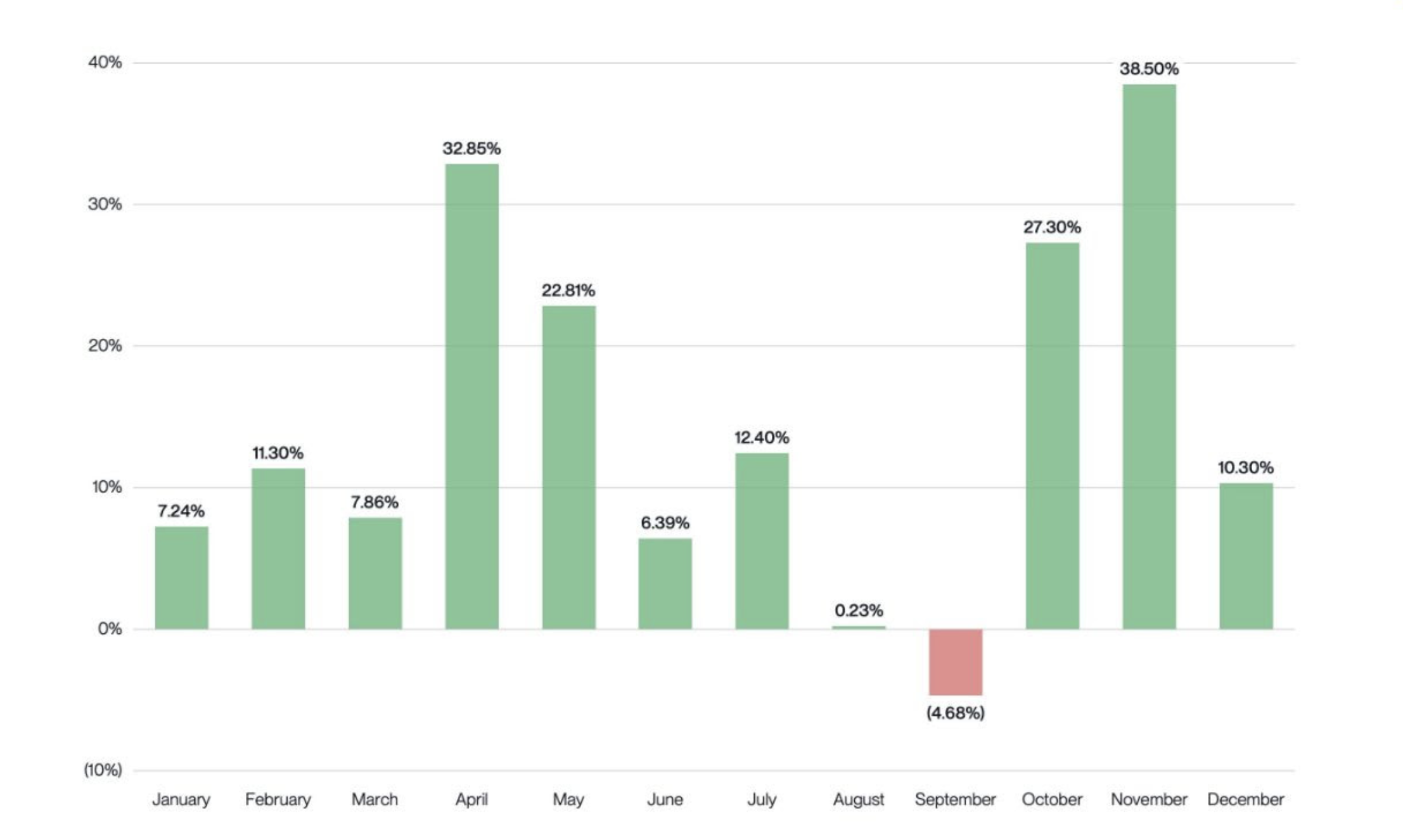

This only reinforces the historical trend that August and September are often tough months for Bitcoin.

But here’s the “half-full” scenario:

If Bitcoin weakens while altcoins remain stable or start moving up – we could be entering a true alt season! 🚀

That means: a period where 75% of the top 50 coins by market cap outperform BTC over 90 days.

And the profits then can be… to put it mildly, “huge.”

👉 If you want to be ready for the next alt season and know which projects have the biggest potential – follow the blog on Altcoins.bg.