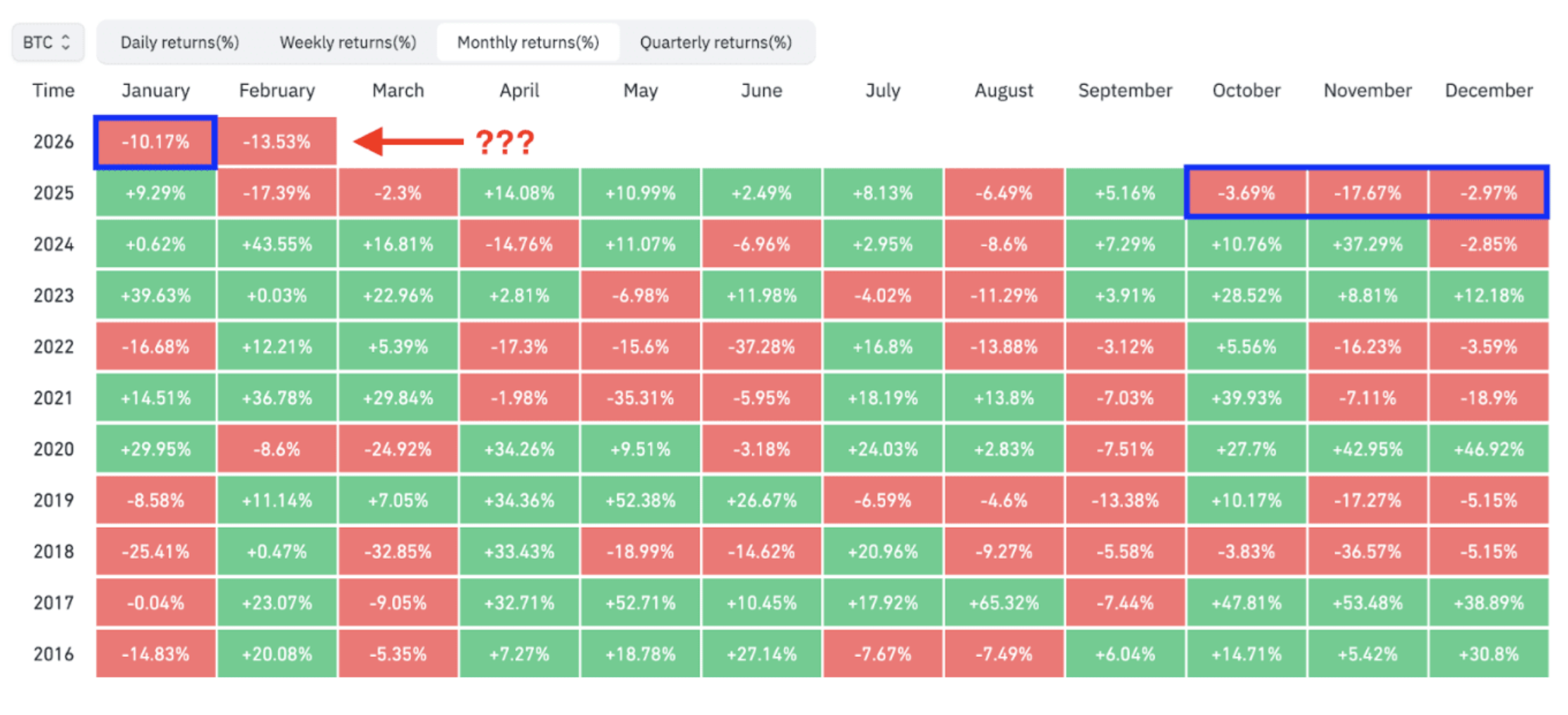

Four red months for Bitcoin. Is the fifth coming?

Bitcoin has just logged 4 consecutive red months – something we haven’t seen since 2018.

And now there’s a real chance it becomes… five.

Meanwhile, selling pressure in altcoins is at its highest level in 5 years.

It doesn’t sound pleasant. And it isn’t.

But in moments like this, the market isn’t testing price – it’s testing your psychology.

How rare is this, really?

Historically, the “record” for BTC is 6 consecutive red months (August – January 2018/2019).

That is the only period in which we’ve gone beyond 4 straight down months.

If February closes in the red, it will be only the second such case in history.

In other words – we’re in a statistically rare situation.

The worst-case scenario?

Analysts point to a potential bottom in the $40,000 – $50,000 range.

That would mean a break below the 200-week moving average, a zone that has historically often served as long-term support.

A scenario like that would likely lead to:

- sideways price action for months

- fading market interest

- capitulation from the more impatient participants

Not attractive. But possible.

The best-case scenario?

That the bottom was already set on February 5.

Bulls believe this is an accumulation phase.

Bears look at the classic post-halving cycle and expect a deeper correction, with a potential reversal later in the year.

Altcoins are under serious pressure

For 13 consecutive months, selling has dominated altcoins, excluding Bitcoin and Ethereum.

The 1-year cumulative buyer vs. seller delta metric has collapsed to levels that are roughly 3 times worse than the period around the FTX crash.

And yet...

Total altcoin market capitalization is holding around $700 billion. That’s a meaningful drop from last year’s $1.2 trillion peak, but the market is still moving within the range we’ve been observing since November 2024.

There is pressure. There is uncertainty, too. But for now we’re not seeing panic-driven breakdown – more like a holding pattern.

What could change the picture?

A few factors could have a positive impact:

- Bitcoin stabilizes its price and holds above key levels

- Easing financial conditions and expectations for interest rate cuts

- Progress on U.S. regulation, including around the CLARITY Act

The first factor would restore confidence. The others could accelerate the recovery.

Our take

Trying to nail the exact month of a reversal rarely provides an edge. History shows that the toughest periods often coincide with the best long-term opportunities.

One approach many investors choose in an environment like this is gradual buying over time. That reduces the risk of bad timing and helps build a position calmly and with discipline.

Over a 5 to 10-year horizon, individual months lose their importance.

At Altcoins.bg, we believe in a reasonable approach.

The market always goes through tough phases. The question is whether you’ll use them to your advantage – or let them dictate your actions.

The content is for informational purposes only and should not be considered financial or investment advice.